Green comments in response to the recent crisis in UK domestic energy prices have claimed that the ‘gas market’ is responsible.

The CarbonBrief blog, for example (which is also the origin of the false claim that “wind power is nine times cheaper than gas“) claims that “An 11-fold increase in UK wholesale gas prices since 2019 explains 96% of the increase in household energy bills”, and that,

According to a 2011 “factsheet” from energy regulator Ofgem: “Higher gas prices have been the main driver of increasing energy bills over the last eight years [since 2003].”

At the LSE, green campaigning academic Annushka Ahuja writes that,

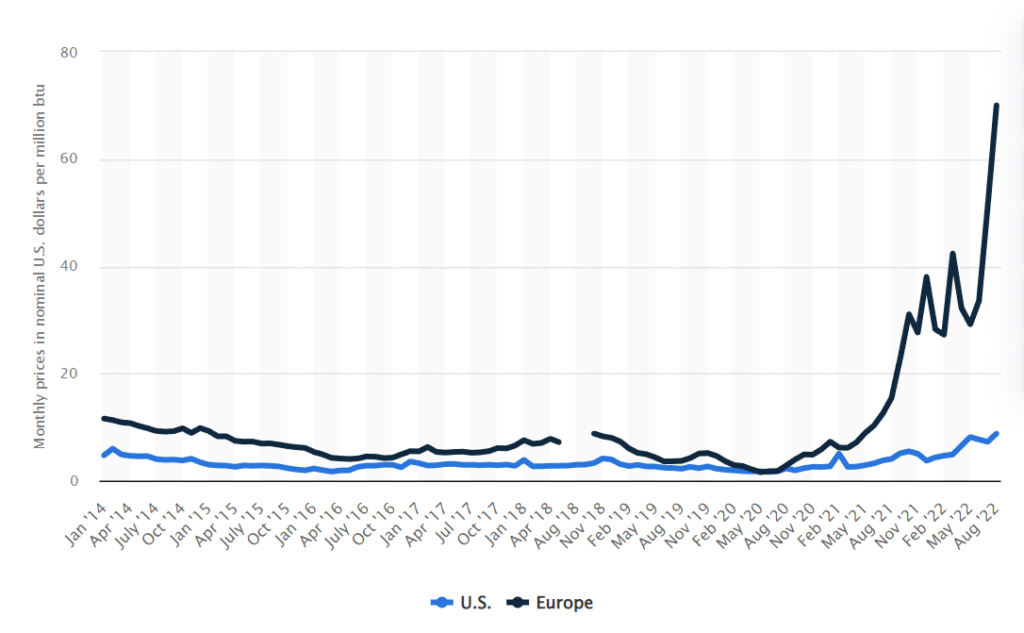

The energy crisis has been building up over the past year, as increased demand during the post-Covid reopening of economies coincided with Russia’s invasion of Ukraine and a subsequent squeeze on gas supplies into Europe. Consequently, a steep rise in the wholesale price of gas has driven up the amount that energy providers pay for gas and electricity – and that cost is now being passed on to the consumer – though recent policy interventions have somewhat helped cushion the extent of this impact.

Typically, attempts from green lobbyists cite the rising cost of gas to argue for more “investment” in renewable generation.

But these claims only tell half the story. Gas prices have risen, but the volatility of gas market prices is not mysterious. Campaigners and politicians who claim that the market is beyond their control are trying to avoid responsibility for their own actions.

First, the historic price of gas shows that low prices are technically feasible. In the past, and until the lockdowns and before countries’ sanctions against Russia for its invasion of Ukraine, gas prices were much lower than they are now, and far lower than the price of wind power.

Second, the EU and many member states and the UK have produced legislation that either limits or prevents new gas exploration. Spain, Germany, France, Denmark, Ireland, Italy, Portugal, and the UK have all imposed limits on hydrocarbon energy production in recent years, despite being gas consumers. This has increased dependence on imports, most controversially from Russia, but also from undemocratic regimes such as Qatar. European countries have also put financial restrictions on energy companies. [H/t to John Dodders for the info].

Third, the UN and G20 central banks have pushed for ESG targets, in collusion with green financial lobbying interests, to mobilise shareholder activists to put pressure on financial institutions to withdraw services, such as finance and insurance, in order to prevent further gas exploration. Furthermore, those same lobbying interests have stated their intention to use the legal process to prevent new licenses being granted to energy companies, continuing the campaign of lawfare to undermine oil and gas companies’ share value by trying to hold them liable for damages they claim will be caused by global warming. ESG, divestment and lawfare campaigning organisations have been extremely successful in raising the costs of oil and gas projects, thereby limiting the supply and increasing costs to consumers in Europe.

Fourth, citing climate concerns, international agencies such as the World Bank have stopped financing oil and gas projects in developing economies. This has reduced the economic outlook for some of the world’s poorest countries, in the most dire need of development and reliable sources of energy. This has led to well-founded criticism that the World Bank is in fact anti-development.

Fifth, despite claims that there is a “global market” for natural gas, the effect of different policy regimes can be clearly demonstrated by a comparison of natural gas prices in Europe and the USA. The USA, which has permitted shale gas exploration has markedly lower natural gas prices, and has not been exposed to recent energy prices to the same extent as Europeans. Domestic energy production, nearly banned in Europe, has allowed American industries and its economy to be relatively unaffected, and even to be advantaged by recent events.

The claim that gas is driving the current crisis is therefore entirely disingenuous. It is green policy that has driven gas price rises.