- Carbon taxes and emissions-trading schemes have subsidised wind farms and other renewables, disguising the true cost of their energy production but without leading to significant displacement of hydrocarbons.

- Promises made about the ability of wind farms to produce energy at low prices have proven false.

- The estimates of emission reductions used to justify such policies have not been reached which means they fail both on their own terms and, given the overall cost to the economy, are highly damaging.

According to environmental economics, global warming and its consequences are an ‘externality’ – a cost incurred by society, which is not included in the price of fossil fuels. In order to correct this failure, various ideas have been proposed and implemented as policy, which bring this cost back into the price. By adding to the cost of fossil fuels, policymakers believed that an incentive would be created to find ways to use energy more efficiently, to find alternatives, and to make renewable energy work better at a lower price.

But many problems are created by this understanding. First, as is explained in the section on emissions reduction, abundant, reliable and affordable energy has created immense social good, not merely improving countless lives, but making billions of lives possible, compared with earlier eras. Second, as is explained in the sections under column 2, there are no detectable social harms caused by climate change in any observable metrics of human welfare. Third, what harms are claimed to be the consequence of climate change have been produced by questionable modelling techniques, as is explained by the section on modelling, not by observation. And fourth, where seemingly climate-related problems do occur, they are typically found in poorer parts of the world, where the need for wealth and development, including access to affordable and reliable energy, are far greater problems than climate change.

However, despite lacking a rational foundation in observations, climate change researchers have claimed that the externalities from fossil fuel use can be calculated, or at least estimated in a metric called the Social Cost of Carbon (SCC).

Emissions Trading, also known as ‘cap and trade’, creates a market for permits to emit a certain amount of CO2 (or other greenhouse gases), and these are typically distributed to large industrial plant operators, such as coal or gas-fired power stations. The number of these permits are gradually reduced, causing their value to rise. In theory, this incentivises an operator to seek ways to reduce their emissions, and then sell the surplus permits on the market. An operator who fails to find ways of reducing emissions faces having to pay a rising price for emissions permits or pay punitive fines for exceeded allowances.

Carbon taxes are a more direct way of applying putative ‘externalities’ to the price of fossil fuels. Sometimes, though they are not called ‘carbon taxes’, they are intended to tax carbon dioxide to reduce emissions through punitive rates. For example, fuel excise taxes, payable on petrol and diesel (and other fuels) at the point of sale were subject to an ‘escalator’ – a commitment to annual increases, to discourage fuel use. But recent governments have been inclined to freeze the escalator, as high energy prices became a political issue.

The UK implements a mixture of emissions trading and carbon taxes, with some forms of energy use being subject to greater levies than others, and applied at different points between production and end-use. Since leaving the EU, the UK has implemented its own ETS. Furthermore, emissions from the UK’s power generation is regulated through the complex Contracts for Difference (CfD) process, which replaces the older systems of subsidy for renewable energy, the Renewables Obligation scheme (RO), which required suppliers to source an increasing proportion of their electricity from renewables. The CfD scheme succeeded the RO scheme because of its failures, but the RO scheme continues to subsidise generators that were built before the CfD scheme came into effect in 2017.

Data provided by the energy regulator Ofgem, shows that in the year ending March 2021, subsidies to renewable energy generators under the RO scheme totalled £5.73 billion. The RO scheme’s punitive ‘buy-out and late payment’ fund added a further £465.9 million, bringing the total cost to the consumer to nearly £6.2 billion.

Costs of the CfD scheme are harder to calculate because, unlike with the RO, generators offer a ‘strike price’ (a bid) to the regulator. In this arrangement, generators will receive this price for electricity if the market price is below it. If the market price for electricity exceeds the strike price, then the generator will have to pay the difference back to the consumer. But according to a 2021 analysis by the Global Warming Policy Foundation in 2017, electricity from offshore wind farms costs ‘£125–150/MWh, approximately three or four times the cost of electricity from gas turbines’.

The GWPF’s claim sits in contrast to low strike prices offered by offshore wind farm developers in the early days of the CfD scheme. In 2017, developers of planned offshore wind farms at Triton Knoll, Hornsea 2 and Moray East offered bids of £74.75/MWh for the former and £57.50/MWh for the latter two. These bids have generated many headlines in the following five years, claiming that wind power is now competitive with generation from fossil fuels. However, the GWPF pointed out in the same year and since that these strike prices were unrealistic, and not supported by evidence that the costs of offshore wind farm development had fallen sufficiently to make these prices viable. Moreover, the GWPF pointed out that these bids were quoted in 2012 prices, and so were subject to adjustment for inflation, and that these strike prices were not enforceable – the developer could simply sell the electricity to the grid at the market price.

At the time of writing, only the Moray East wind farm has been completed. Its current strike price is listed as £68.55/MWh. But just as the GWPF had predicted, it has not been selling electricity to the grid under the CfD scheme at these prices, but at much higher market rates. According to other analysts, the CfD scheme had created a ‘significant commercial incentive’ to delay joining it. According to the CfD rules a developer has a three-year window in which to join the scheme, if it wishes to at all – a fact which was not revealed to the public in claims that the cost of wind-power had fallen. The department for Business, Energy and Industrial Strategy has asked the developer to “act fairly”, but there is no mechanism for holding developers to account. Despite this looming possibility of a catastrophic policy failure created in its first round, exacerbated by high energy prices, the government went ahead with a fourth round of auctions for the next wave of 11 GW of capacity under the CfD scheme in July 2022, attracting bids as low as £37.35/MWh at 2012 prices.

The problem of allowing potentially false bids in auctions for enforceable contracts is that it has undermined the development of reliable and affordable infrastructure. This is revealed by boasts from the sector in 2017, when unrealistic bids were first offered. According to a press release by a law firm representing green tech clients, the low bids meant that ‘The UK Government will surely come under pressure to reconsider its support for nuclear power’. This problem is given even greater significance when seen in the light of the consequences of renewable energy policy since the mid 2000s.

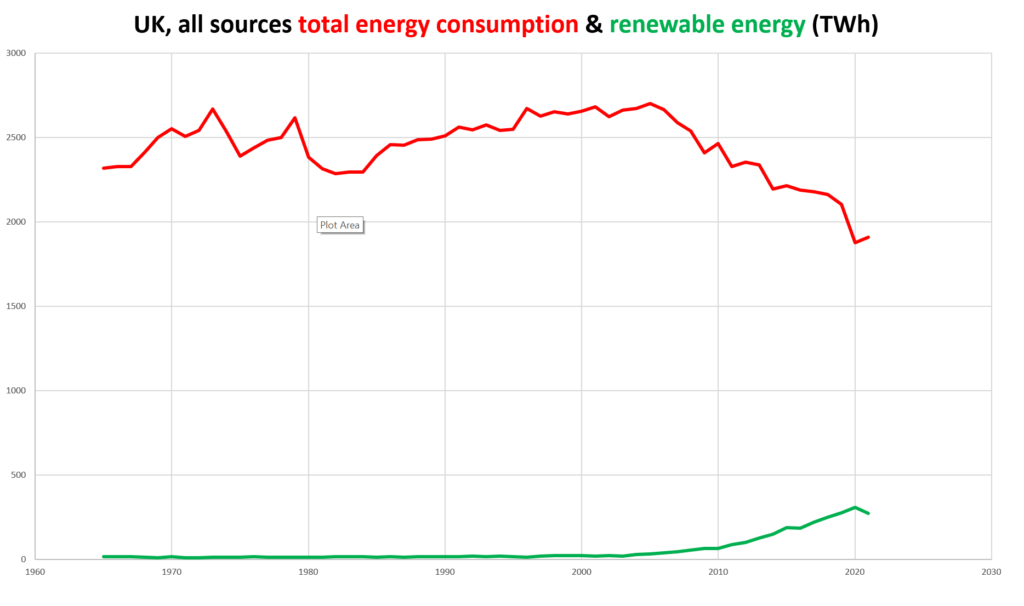

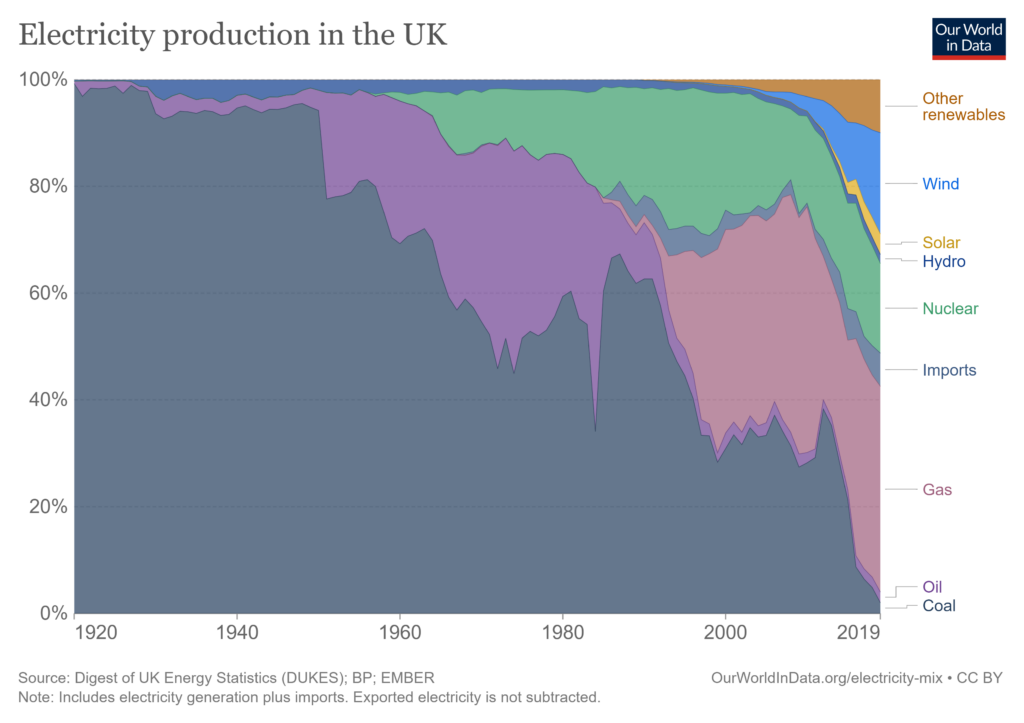

As is discussed in the section on emissions-reduction targets, renewable energy has displaced just a small amount of power generation from hydrocarbon fuels, whereas the greater part has been achieved through energy demand reduction, mostly as a consequence of rising energy prices and the offshoring of UK industry. This pattern is also shown in the UK’s mix of electricity sources.

Electricity production peaked in 2005, at 404 TWh, falling to 341 TWh in 2019 – a reduction of 63 TWh, or nearly 16 per cent – achieved largely through the rapid closure of coal fired power stations, but also gas, nuclear and oil-fired plants equivalent to nearly 30.3 GW of capacity, with a theoretical capacity to deliver 265 TWh of mainly baseload and affordable power a year.

{INSERT TABLE}

In 2019, renewable energy, including hydrogen, produced just 117.34 TWh of electricity – less than half of the potential capacity taken offline and demolished by EU and UK climate and energy policy in the decade since 2012. Moreover, this replacement provides neither baseload supply nor dispatchable power – in other words it is unable to provide secure supply when required, only when the weather permits.

In the wake of extremely high energy prices caused by the gas supply crisis, renewable energy lobbyists have argued that this proves the case for expansion of the UK’s wind and solar fleet. However, as the above discussion shows, wind farm developers have taken advantage of schemes such as CfDs in order to secure finance for their projects, but have yet to prove that they can produce power at the prices they have offered to supply, and which is competitive with gas, despite the volatility of gas prices on international markets. Moreover, these high electricity prices were caused by the UK power grid’s dependence on gas, caused in large part by the closure of plants fired by conventional sources (coal, oil and nuclear). Regulators were persuaded against replacing these with new nuclear, because low and perhaps misleading bids offered by wind generators made them seem both expensive and unnecessary. This has worsened the current situation significantly by creating the necessity of using gas to balance against the variability of wind.

Furthermore, as a result of very successful green campaigning, new oil and gas exploration, including fracking, was prohibited in many European countries. Despite its potential being highlighted in the late 2000s, the UK banned exploratory fracking in 2019 after years of a moratorium being in place. Thus Europe’s capacity to produce gas was extremely limited, and a recovery from the covid lockdowns left producers unable to meet demand, pushing prices to their highest levels. (For more on this point, see the section on financial regulation & ESG.)

Had the EU and UK not been so averse to domestic production of hydrocarbons, the continent would have been less dependent on Russian imports, and regional markets for gas would have not been so volatile. And had the UK’s transformation of the power sector been approached more cautiously by policymakers, alternative plants would have been able to provide power at a much cheaper price. But after the policy failures of ETS, RO and CfD schemes, capacity has been reduced and prices have been substantially increased, leading to a multiplication of domestic and commercial energy bills over the era of green policymaking, and a loss of industry and global competitiveness. While these schemes make big promises to create a ‘green industrial revolution’, ‘green jobs’ and a ‘green economy’, precisely the opposite effects can be observed: deindustrialisation, a reduction in the amount of available energy, a loss of energy security, an increase of energy poverty and the costs of living, the loss of jobs in productive sectors of the economy, and increased dependence on imports of energy, resources, and manufactured goods.

According to a 2022 analysis by the GWPF, the success of energy policies can be judged as failures on their own terms – comparing the costs of policies such as ETS against the Social Cost of Carbon (SCC). As the following chart from the reports shows, uncontroversial analyses of the costs of UK and EU member states’ policies far exceed a reasonable SCC estimate of 100 Euros per tonne of CO2.

In other words, the only reasonable conclusion from such a comparison is that climate policy – and specifically attempts to internalise the externalities of CO2 emissions – are more harmful than climate change itself. Advocates of green policies claim success in reducing emissions and switching from hydrocarbon energy sources to renewables. But these claims do not take into account the far-reaching social and economic consequences of those policies, which have deliberately and fundamentally altered the structure of European countries’ economies, and are causing deep political problems and social unrest.